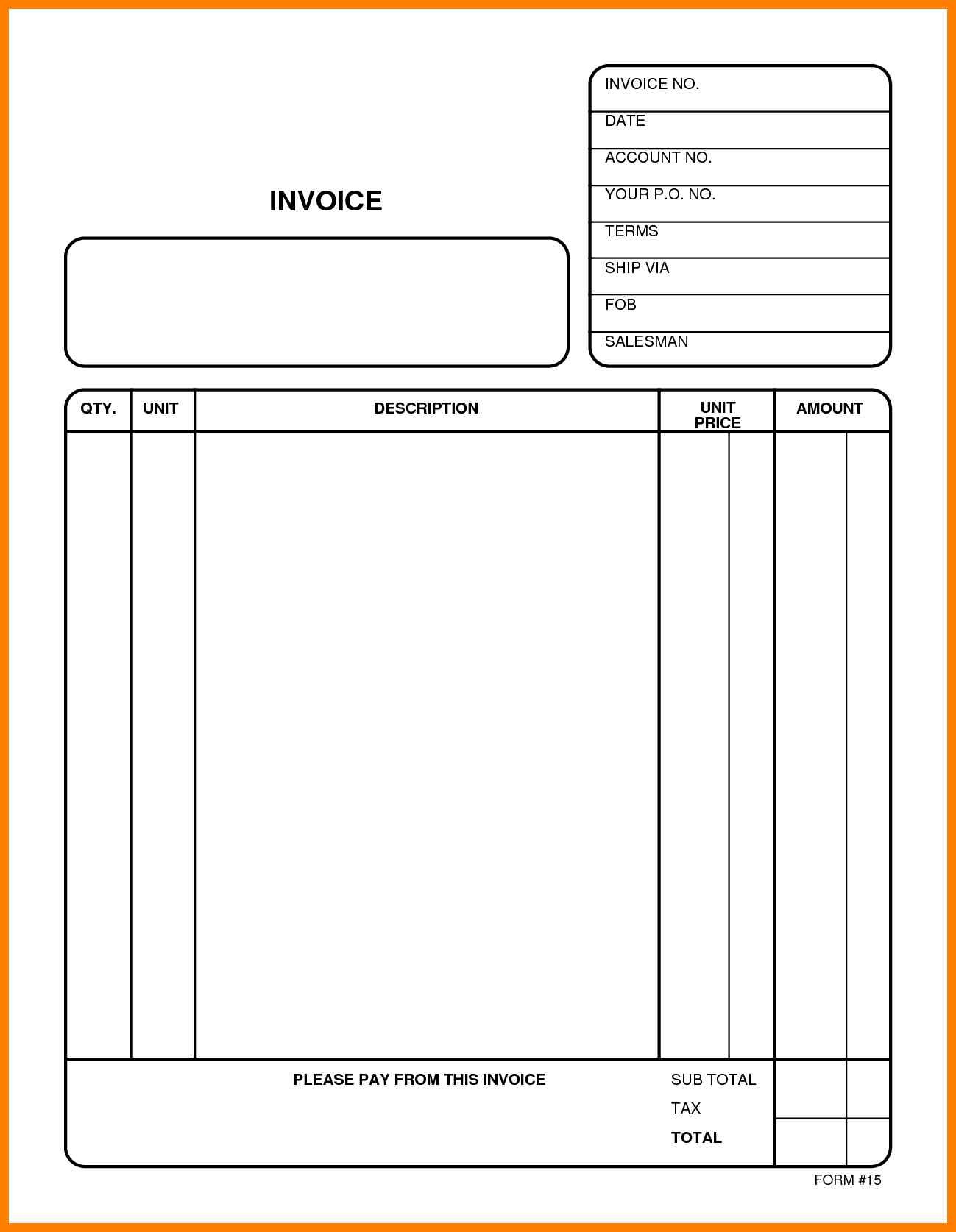

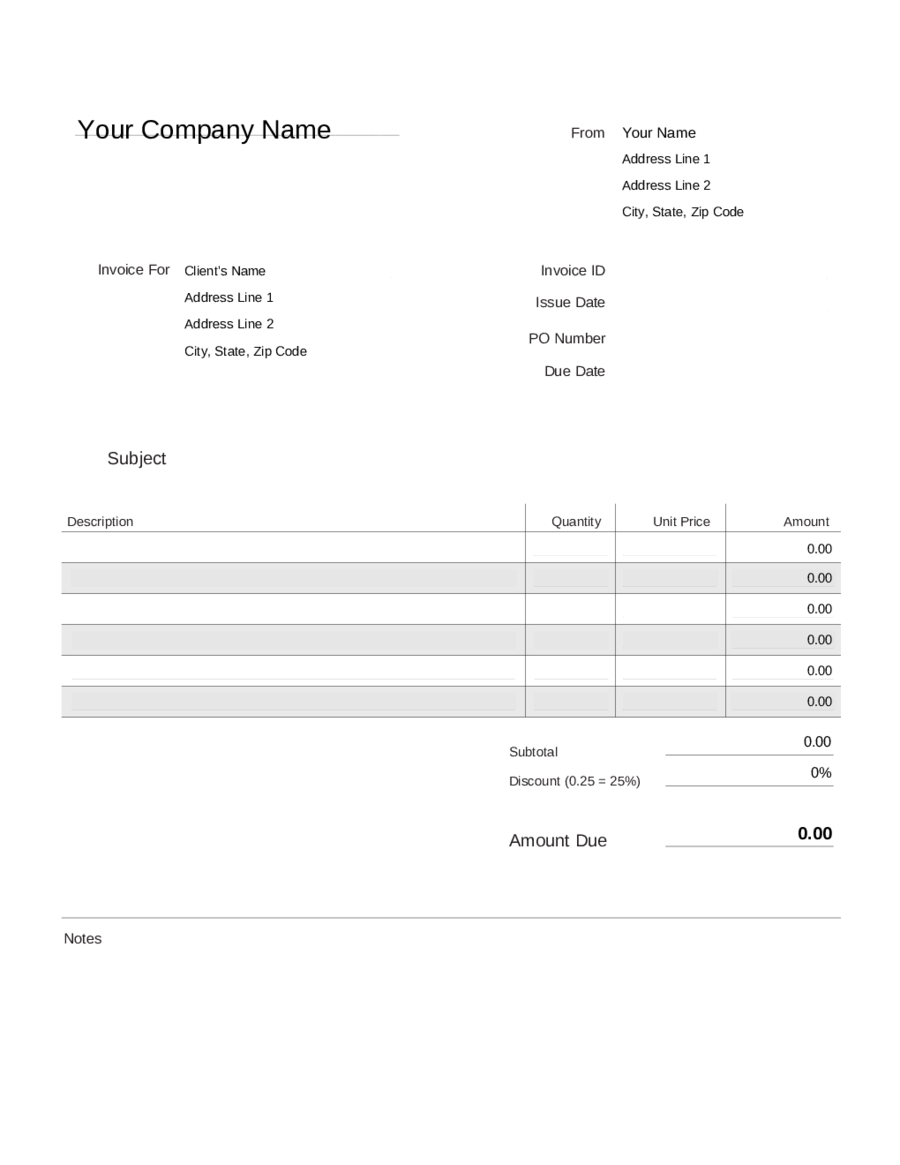

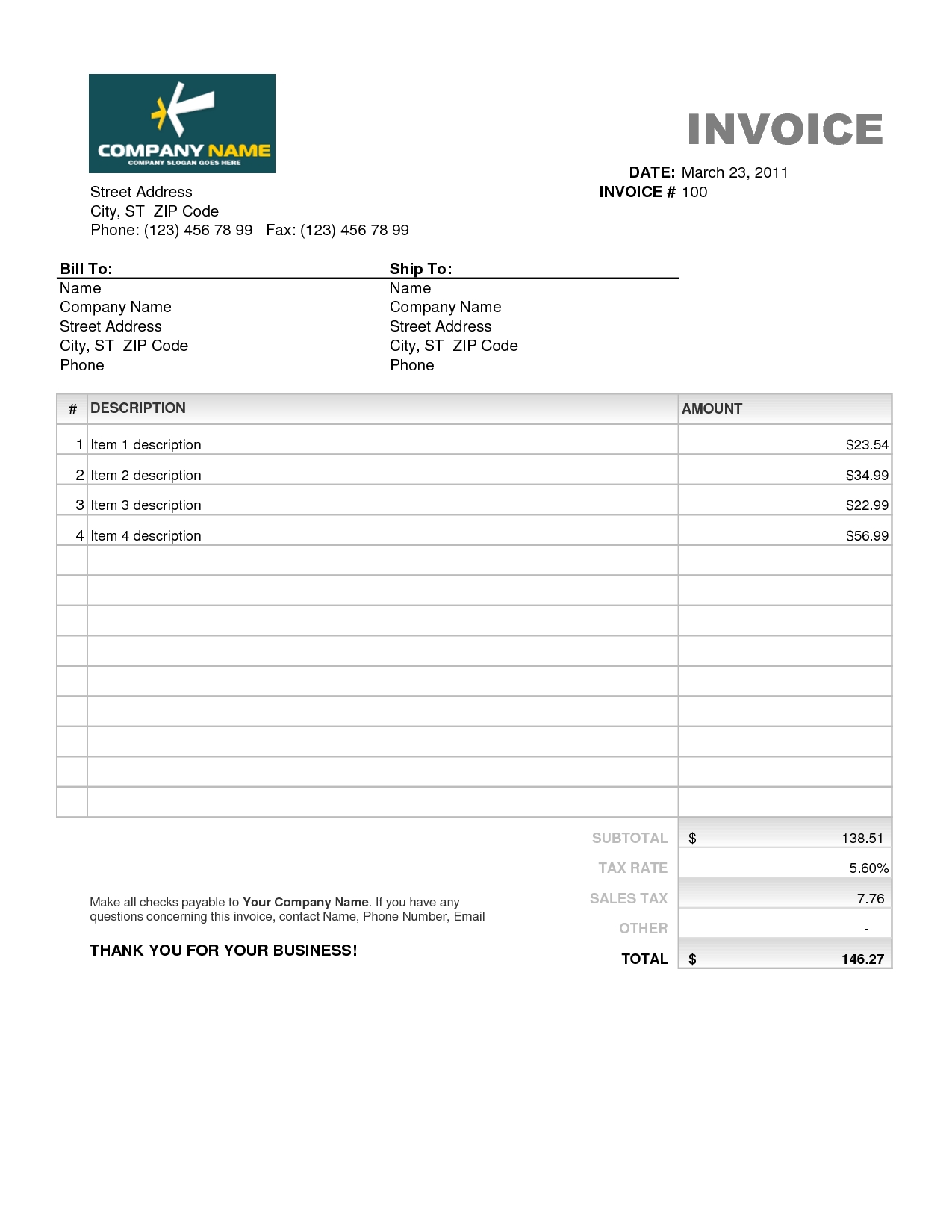

Assign each invoice you issue with a unique invoice number, and document the invoice number directly on the invoice and in your records. Numbered invoices help ensure that your business income is properly documented when it comes time to pay taxes. Numbering your invoices makes it easy to track payments and keep your accounting records straight. Accurate documentation of the invoices you issue can help you spot outstanding payments as soon as they’re overdue and improve cash flow. Keep track of your invoices using an invoice tracking system, like a spreadsheet or accounting software that automatically records the status of your invoices. Be sure to track your sent invoices, making note of when the invoice was issued and when payment is due. Then you can either print and mail the invoice to your customer’s billing address, or send the invoice to your customer’s email address. To send an invoice to your customers, first save the completed invoice template. Clear descriptions of the goods or services you’re billing againstīeyond these important requirements, you can adjust your invoices to meet the needs of your business.The invoice number assigned to the invoice you are creating.Include the following elements on each invoice you create: Use the fillable invoice template to create an invoice by completing the blank fields in the template with your business, sale, and customer information. An invoice template outlines the necessary fields included on an invoice. Read more about the difference between a Proforma Invoice and Commercial Invoice.An invoice template is a document that makes it simple to create new invoices. Using IncoDocs, exporters can convert a Proforma Invoice into a Commercial Invoice in 1 click without re-typing any information.

The Commercial Invoice will contain the actual final product quantity and balance amount to pay and will be used by the importer during the customs clearance process. A commercial invoice is usually issued after the goods have been supplied.

Once the goods have been produced and are ready for shipment, sellers will request the balance amount to be paid on a Proforma or Commercial invoice. before the goods have been produced or delivered. Note that Proforma Invoices are issued pre-shipment, i.e. In the global trade process, usually the exporter will require a deposit payment to confirm the order and start manufacturing the goods.Ī common example is a 30% deposit payment up front, and the 70% balance payment after the goods have been produced or shipped (the specific terms to be negotiated and agreed between the buyer and seller). At the beginning of a new order to be shipped Internationally, the seller will share the Proforma Invoice document to the buyer to confirm the order details and usually request a part payment.

0 kommentar(er)

0 kommentar(er)